Signs That the Bottom Is In

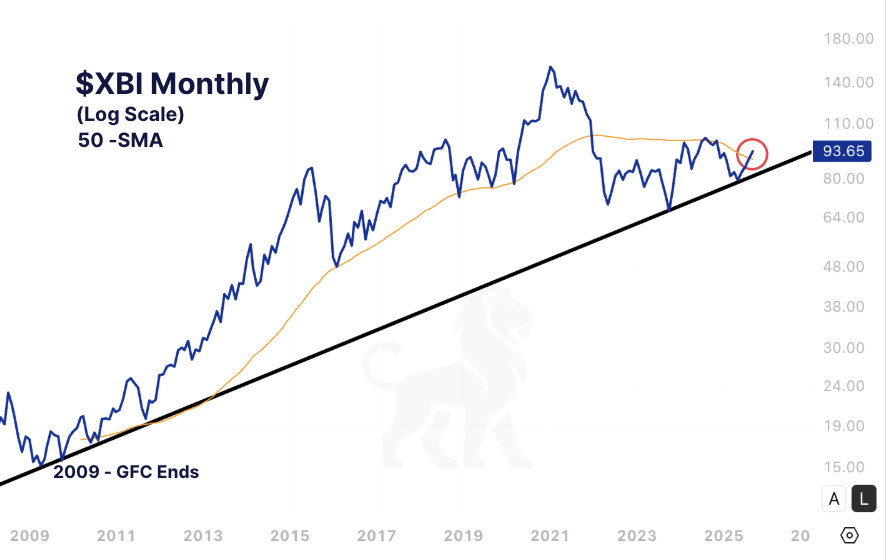

1. XBI Is Holding Its Long-Term Macro Trend

Despite volatility over the past few years, $XBI has held its long-term logarithmic support trendline dating back to the 2009 lows. The May 2022 and October 2023 lows formed a double bottom, which now appears to be a durable floor.

2. Reclaiming the 50-Month SMA

$XBI is now trading above its 50-day, 100-day, and 200-day SMAs, with bullish crossovers forming a strong technical sign of trend reversal. Vitaly important, it has reclaimed its 50-month moving average, a macro indicator often associated with the beginning of a new uptrend and bull phase. (Orange line on chart)

3. Fed Rate Cuts on the Horizon

The Federal Reserve is widely expected to cut interest rates in September 2025, which would lower capital costs very important for biotech.

A Few Catalysts That Could Spark a Biotech Hiring Boom

The end of the bear market is one thing but what might actually spark biotech hiring again? Here are two key catalysts:

1. Regulatory Tailwinds

- The FDA just proposed a new rare disease approval pathway, allowing approvals based on single-arm trials supported by biomarkers which could greatly accelerate drug development and I'm guessing could start hiring in clinical and regulatory roles.

- The agency is also reducing approval review times and restaffing its own workforce after prior budget cuts.

2. U.S. Biomanufacturing Expansion

Major pharma players are massively expanding domestic operations:

- Eli Lilly: $27B investment across four new U.S. sites

- Johnson & Johnson: $55B including new NC plants

- Roche, Pfizer, Sanofi, Amgen, and others are supposed to follow suit

I guessing this supports hundreds (if not thousands) of manufacturing jobs, quality, and technical roles.

Are Layoffs Really Over?

While optimism is returning, layoffs haven’t entirely stopped. We’re likely at the end of the worst but a few companies are still trimming headcount due to failed programs or over-expansion.

So…Is the Bottom In and Is Biotech Hiring Again?

Likely Yes - But We Still Need Confirmation

All signs suggest that the biotech bear market is ending, and we are in the early innings of a recovery:

- $XBI has held key support and reclaimed major moving averages

- The Fed is likely to cut rates soon

- Regulatory, M&A, and innovation catalysts are aligning

Hiring is resuming in key areas, but not yet across the board. In my opinion we’re likely to see continued layoffs at a handful of maybe small to mid-cap biotechs.

We hope the positive trends continue and if they do we could be entering a phase of expansion after a long period of cost-cutting and restructuring.