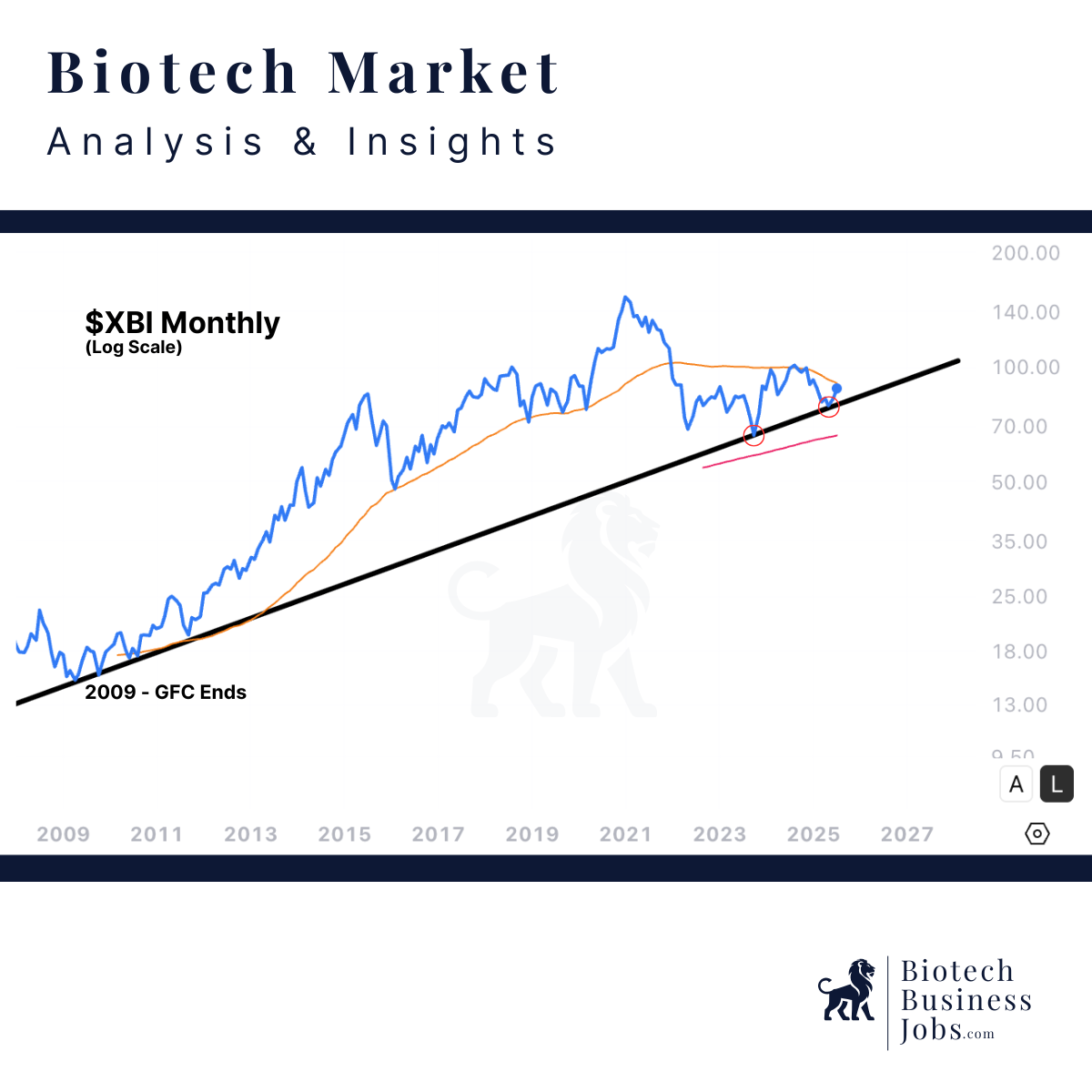

The XBI, a key biotech ETF, is currently holding strong to its long-term trend on the monthly log scale dating all the way back to the end of the GFC in 2009. After a long period of volatility, we are hoping this stability could signal the end of the layoffs that have plagued our Industry.

Chart Analysis

- Broke below the 50 SMA (orange) in Jan. 2022 marking the bear market for biotech

- Held long-term trend in Oct. 2023 and again in May 2025 (circled in the chart)

- Holding the long term trend on the monthly is a huge deal

- Things are looking good for the moment

If this trend holds, we may be on the cusp of a new phase for biotech. Where hiring ramps up, talent demand grows, and innovation accelerates once again.

What Could this mean for the biotech industry?

- Hiring rebound: Companies may start investing in new talent to fuel growth and innovation.

- R&D surge: As the market stabilizes, biotech firms can focus on long-term research projects and drug development.

- Investment confidence: Stability in biotech stocks could encourage both venture capital and institutional investors to renew their support.

We hope this trends continues and if it does we could be entering a phase of expansion after a long period of cost-cutting and restructuring.